ByteSnap’s Electronics Industry Trends for 2023

From Matter to how smart technology will come of age as it contributes hugely towards energy cost reduction, and handling continued supply chain pressures, ByteSnap’s award-winning engineers have been reflecting on the tech year ahead. We share our views on industry trends that we believe will drive growth in the embedded electronics sector, in 2023.

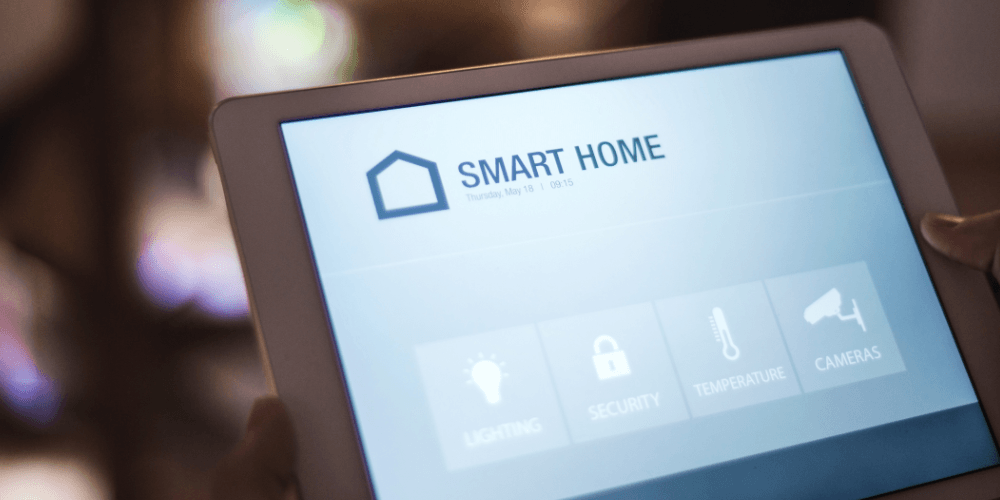

Smart home and automation trends…

1. Subscription fatigue set to continue

Subscription fatigue appears to have arrived with many people cancelling subscription renewals amidst the financial crisis. This will only grow – we believe that software as a service add-on will dissuade people from purchasing new devices in 2023, if that device comes with a continued cost. For example, paying a subscription to get air conditioning in your new car (as BMW’s new models allow) seems a step too far, especially when the new best-selling car in Germany (Tesla Model Y) comes free of subscription payments.

2. Uptake of machine learning (ML) techniques as they become more accessible

We will see advanced ML techniques appearing in core business offerings such as kitchen products e.g., teach your toaster to produce the perfect toasted bread rather than a basic timer, or the perfectly timed popcorn in the microwave. Such devices just require basic sensors. Advanced ML will also be present across further business areas, such as medical and science data, to enhance lives.

3. AI art to be sold professionally and new jobs created

With the release of DALL-E 2, AI image creation is reaching the level where art created using the technique could be distributed and sold en masse, and for large sums of money. We envision an exhibition of AI-generated art popping up in an art gallery next year.

Further, with the release of similar tools using AI to generate images and other complex ideas, the job of refining the input to an AI or other machine learning tool will be needed – for example fine tuning the string of words given to AI art generators to tweak the final image for the desired result. This will become especially important as the inside workings of a complex machine learning tool are currently very opaque.

4. Matter to be widely supported in home automation industry

The growth in automation has boomed over the last 5 years, but there still needs to be a standard to link devices and have a single point of control. For this reason, we predict Matter (standard) will gain traction on a large scale, especially as the first wave of Matter devices are being released, which will help homes to become smarter.

Matter is the new smart home IoT push from some big Industry players – Silicon Labs have teamed up with big Industry players like Google and Amazon to provide a new IoT framework called Matter.

While still in its early days, the project is exciting and could be a genuinely refreshing technology in what was becoming a complicated market.

It will be interesting to see what Matter-enabled gadgets may do to tomorrow’s IoT and home automation.

5. Large investment into the metaverse, with little initial user engagement

With companies having already invested in NFTs (non-fungible tokens), we foresee attention turning to acquiring virtual land. However, while big investments might be made into these metaverses, we predict an inability to retain value, with an effect similar to the rapid NFT price drops.

If VR metaverses do become popular, then having a well visited plot of virtual land could pay off for marketing, however with a small percentage of the population using VR, and an even smaller number of those users participating in the metaverse, it will be difficult sell at such a high introductory price.

6. Voice control will become more normalised

We predict that as people “trust” voice controls more and more (such as Alexa and similar), this function will grow within mobility control sectors.

Smart home devices & energy management systems (EMS) to help financial crisis…

7. A rise in presence-based automation in smart homes, to save on energy bills

With customers adding smart assistants to their homes, users are getting more used to integrating smart appliances such as smart lights and smart thermostats. We foresee tech savvy users expanding these systems to use presence detection, in order to save money (e.g., turning off lights when no one is in the room, or only heating rooms that people are occupying). We also believe the ultra-high energy prices will force less tech-savvy people to look into connected home energy systems (HES) and standby power solutions. This barrier to entry can perhaps be helped by the likes of popular Alexa and Google Home.

8. A rise in in-built, power monitoring for smart home devices

We foresee the user benefits of purchasing devices with power monitoring plugs, which will help consumers make informed decisions on when is best to run high energy devices, based on their energy tariffs.

9. Big focus on energy saving devices for cost cutting

With lighting and heating making up much of our inflated energy bills, we believe energy savings devices (such as heat pumps, solar panels, battery storage and smart lighting) will become more prevalent.

10. EVs to add pressure to the grid

With the rise of popularity of electric vehicles (EVs), more and more strain will be placed on the grid. This added pressure will drive further need for energy management systems (EMS). We predict that Vehicle-to-grid systems that redirect power back into the grid, will be increasingly considered.

Medical device design and digital health…

11. Remote medical diagnostics set to continue

The coronavirus pandemic has triggered an increase in ‘remote’ medical diagnostics and treatment, cutting down the need for travel and for face-to-face contact with healthcare professionals. We see this popularity continuing in 2023.

Supply and demand for microchips…

12. Demand will continue to move locally, while sourcing volumes will increase

We do not expect a return to ‘normality’ for supply chains in 2023. For many years, Asia has proven to hold a lot of power in silicon manufacturing and so it certainly helps to bring this manufacturing back to Europe or the UK. We predict that it will be a long time until we go back to ‘just-in-time’ manufacturing and that key manufactures will be forced to dual/triple source in years to come.

What are your predictions for the electronics industry in 2023?

Do your predictions line up with ours? We would love to hear your insights and ideas about the exciting year ahead, so get in touch and let us know!